Intermediaries who have already sent at least the 80% of the models can take advantage of the extension from 7 to 23 July, for the submission of the last declarations entrusted to them

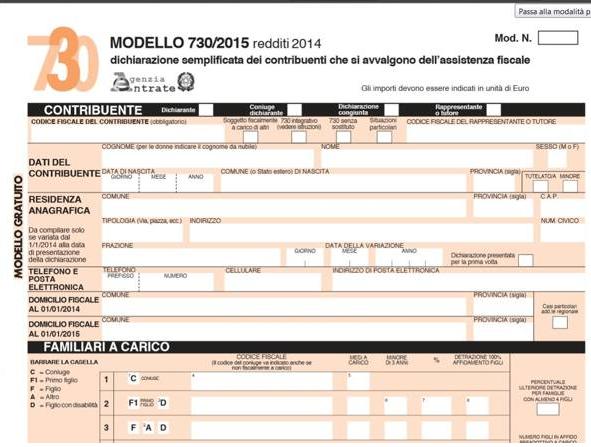

Partial extension for submitting Form 730/2015. The deadline extension from July 7th to July 23rd applies to CAFs and qualified professionals.

The postponement, established by a Prime Ministerial Decree signed on June 26 and currently being published in the Official Journal, as mentioned, affects intermediaries who, as of July 7, have already submitted at least the 80% of the forms entrusted to them by taxpayers for the 2014 tax year. The news was announced in recent days by the Ministry of Economy and Finance in a press release.

In short, further useful space for CAF and professionals:

– for the actual transmission of the 730/2015 form to the Revenue Agency, along with the forms for choosing the destination of 8, 5, and 2 per thousand of the IRPEF (form 730-1)

– for the delivery to the taxpayer of a copy of the completed declaration and the related liquidation statement (i.e. form 730-3)

– to communicate the accounting results of the processed declarations (form 730-4), which the Agency will forward to the tax substitute for adjustments.

The deadline, set for July 7th, remains unchanged:

– for taxpayers who submit their tax return independently, through the application dedicated to the pre-filled 730 form

– for tax substitutes who provide tax assistance directly or through intermediaries

– for intermediaries responsible for transmitting both the 730/2015 and 730-1 forms who have not processed at least the 80% of the work.

Rosa Colucci

Published Thursday, July 2, 2015 Published on FiscoOggi.it (http://www.fiscooggi.it)